Corporations May Use Warrants for Which of the Following Reasons

1To existing stockholders on a pro rata basis. The ease with which convertible debt is sold even if the company has a poor credit rating.

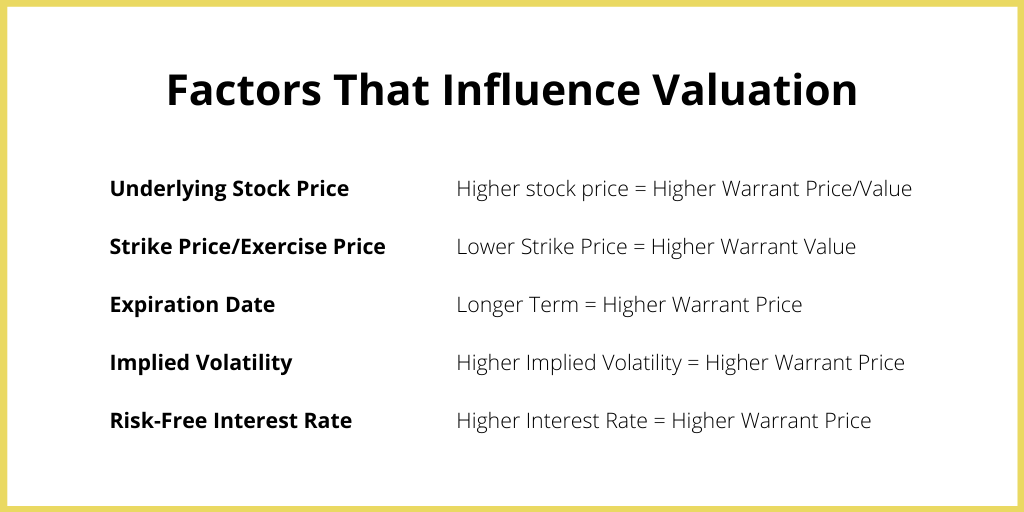

Factors That Influence Black Scholes Warrant Dilution

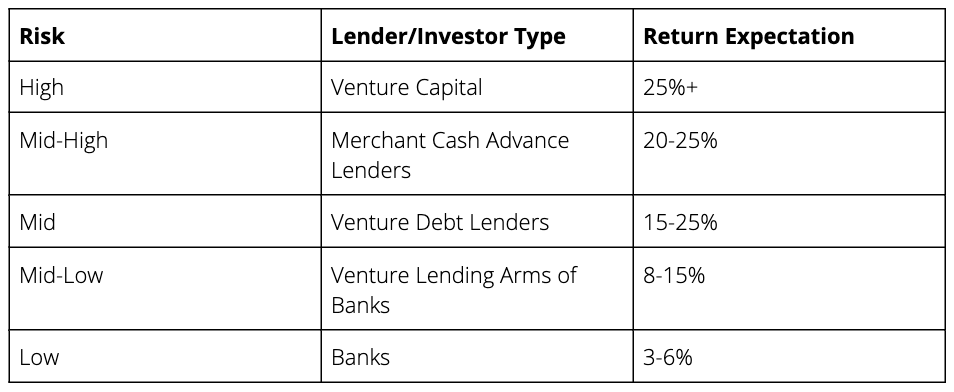

You prefer to use debt but neither your company nor the competitor qualifies for a pure bank loan for that amount.

. To provide a return to the place of distributing cash or shares. Companies may use this user data to improve their quality of servicesproducts to serve their customers better. A contractual obligation and associated legal liability is created when a manufacturer or seller provides a warranty and a buyer relies on the warranty in making his or her purchase decision.

2To certain key employees under an incentive. If the stock price is less than the strike price the warrant may still have time value. Corporations issue convertible debt for two main reasons.

For example warrants may be issued. The fact that equity capital has issue costs that. Also a warrant may be issued as a way of preserving goodwill from the companys shareholders.

While stock option terms are often short warrant contracts are often long lasting up to 15 years. Warrants are given to employees in place of cash. Their conversion to shares also saves the company.

Issuing warrants raises the image of companies because it reflects the confidence of investors in the company who agree to purchase shares of the company at a price higher than the current market price. A law enforcement officer may not arrest a suspect without a warrant even if the officer believes there is probable cause but insufficient time to obtain a warrant. Until the call date of the host asset is reached the warrant can only.

A warrant may guarantee your right to one 10 20 or 100 shares. To obtain information as to business secrets or to assist reveal business secrets b. Further companies can issue warrants as a capitalization option when heading to bankruptcy.

With A Manual of Style for Contract Drafting Kenneth A. Users can load whatever they want on their machines. The investigator doesnt have to get a warrant.

Warrants give an individual the opportunity to buy stock in your company at a preset price for a set period of time. For starters recall that a stock option is a contract between two parties and gives the. The investigator has to get a warrant.

A warranty can be either in writing or oral. Warrants are issued by private parties typically the corporation on which a warrant is based rather than a public options exchange. Your corporation may want to raise 2 million from an investor to acquire a competitor.

The company can gauge the level of confidence among investors through the sensitivity of the premium. Other alternatives such as asserts and confirms carry unnecessary rhetorical. To certain key employees under an.

To find technical defects in corporate transactions in order to bring. Like stock options warrants are a tool businesses can use to reward key employees or investors. Another category is when the law imposes a warranty requiring the manufacturer to meet certain standards.

For various reasons a corporation may issue warrants to purchase shares of its common stock at specified prices that depending on the circumstances may be less than equal to or greater than the current market price. 406The following are purposes of inspection by a shareholder which may warrant denial by corporation except a. Brought to you by Sapling.

Companies may include warrants in employee compensation packages or as part of a capital raising transaction. Convertible bonds offer lower interest rates than comparable conventional bonds so theyre a cost-effective way for the company to raise money. Read the fine print before you buy.

To existing stockholders on a pro rata basis. A stock warrant is similar to its better-known cousin the stock option. Check the Expiration Date.

It will be more easy to convince shareholders to pay 10 per warrant than to purchase. Intrinsic value and time value. The warrant buyers only risk 5 per share XYZ gets the extra 500000 and Company XYZ stands to bring in another 500000 if the.

Business Accounting QA Library For various reasons a corporation may issue warrants to purchase shares of its common stock at specified prices that depending on the circumstances may be less than equal to or greater than the current market price. Most companies keep inventory databases of all hardware and software used. Issuing warrants provides the company with a future source of capital.

Three common reasons for issuing warrants are. Stock warrants are an innovative financial instrument that give holders the right but not the obligation to buy a stock at a certain strike price. For other materials on this topic please refer to the following.

You guessed it issue warrants along with their common. The number of shares you have a right to buy or sell varies with each warrant. To secure business prospects or investment advertising list for the purpose of selling it to an advertising agency c.

For example warrants may be issued. Dont use represents warrants or the phrase represents and warrants to introduce statements of fact. To prevent terrorist activity and minimize violence when the people know that their activity is being tracked by the police.

Companies may also sell warrants directly to investors. A Manual of Style for Contract Drafting. A warrant that can only be exercised if the host asset typically a bond or preferred stock is surrendered.

To achieve this the corporation may issue warrants to its stockholders as a dividend. A law enforcement agent can arrest a suspect without a warrant if the officer believes there is probable cause but not enough time to obtain a warrant. It would be best to introduce statements of fact using the simplest verb available namely states.

The market value of a warrant can be divided into two components. They will set the exercise price at 5 also so 1 warrant plus 5 can be exercised for 1 share of common stock. A warrants lifetime is measured in years as long as 15 years while options are typically measured in months.

What are the reasons for issuing warrants. Company XYZ can issue 100000 warrants at 5. Tracking of users activity by the police may be performed due to following reasons.

The first part of the solution aims to eliminate confusion. A stock warrant gives holders the option to buy company stock at a fixed price the exercise price until the expiration date and receive newly issued stock from the company. Adams has created a uniquely in-depth survey of the building blocks of contract languageThis manual focuses on how to express contract terms in prose that is.

One is the desire to raise equity capital that assuming conversion will arise when the original debt is converted. A warrant is a financial instrument that provides the holder of the warrant the right but not the obligation to buy a companys stock in the future at a predetermined price. An investment firm agrees to lend you 2 million at 9 percent interest but wants 25000 warrants attached.

A Guide To Warrants In Venture Debt Flow Capital

A Guide To Warrants In Venture Debt Flow Capital

/Wiener_Riesen_Rad_Ltd_1898-41accd5aa0f9438198764c26178b58cb.jpg)

Comments

Post a Comment